Depreciation recapture calculator rental property

Your depreciated value would look like this. In this example the property value is 415000 25000 - 83000 building value of 357000.

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

The math gets more complex.

. Rental property provides an investor with several potential passive income streams. Because you sold at 600000 and bought at 500000 your. On top of that California will charge another 1 to 133 when you sell.

Below we will look more in-depth at these three steps. The depreciation expense is calculated by dividing the property cost basis of 100000 by 275 years then multiplying 363636 by the five years the property was held. Once a property is in service for business use or income generation for more than one year you would depreciate it an equal amount at 3636 for each year its rented up to 275.

Your actual tax on the sale at a profit seemingly for federal purposes will be some combination of depreciation recapture taxed at. May 31 2019 451 PM. Capital Gains Tax Example.

Ad Depreciation Recapture in a Section 1031 Tax-Deferred Exchange. You earn equity in your home. Cost basis x depreciation rate x number of years 220000 x 003636 x 10 79992 That means you could save close to.

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Calculate Understand Your Potential Returns.

A taxpayer uses the depreciation deductions to. Your investment property appreciates over time. Depreciation - Life of AssetTo determine the classification of property being depreciated whether it is 3-year property 5-year property etc refer to IRS Instructions for.

D dstproperties1031 is a Full Service Real Estate Company in the Tri-State Area. Reduce Your Income Taxes - Request Your Free Quote - Call Today. Depreciation recapture refers to the whole or part of the realized gain from selling depreciable property identified to tax as ordinary income.

Ad Property Can Be An Excellent Investment. Reduce Your Income Taxes - Request Your Free Quote - Call Today. Ad Get A Free No Obligation Cost Segregation Analysis Today.

Plan Your Property Investment Returns With AARPs Investment Property Calculator. You collect rent monthly. The capital gain will be 300000 20000 x 11 which.

So if youre a millionaire your total capital gains taxes will be 333. Ad Get A Free No Obligation Cost Segregation Analysis Today. Website 4 days ago 4.

Lastly calculate your specific depreciation schedule with the help of a rental property depreciation calculator. Using the example above imagine youve owned your property for two years when you decide to sell. The total amount of tax that the taxpayer will owe on the sale of this rental property is 015 x 155000 025 x 110000 23250 27500 50750.

5 Okay subtract the total depreciation expense calculated in Step 2 from the total gain to compute your capital gain as opposed to your depreciation recapture gain. Rules Schedule Recapture. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Calculate the Capital Gain on the Rental Property. The next step is to calculate the estimated annual deprecation.

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Understanding Rental Property Depreciation Recapture In 2022

Rental Property Depreciation How It Works Mashvisor

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Use Rental Property Depreciation To Your Advantage

Tax Benefits Of Accelerated Depreciation On Rental Property

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

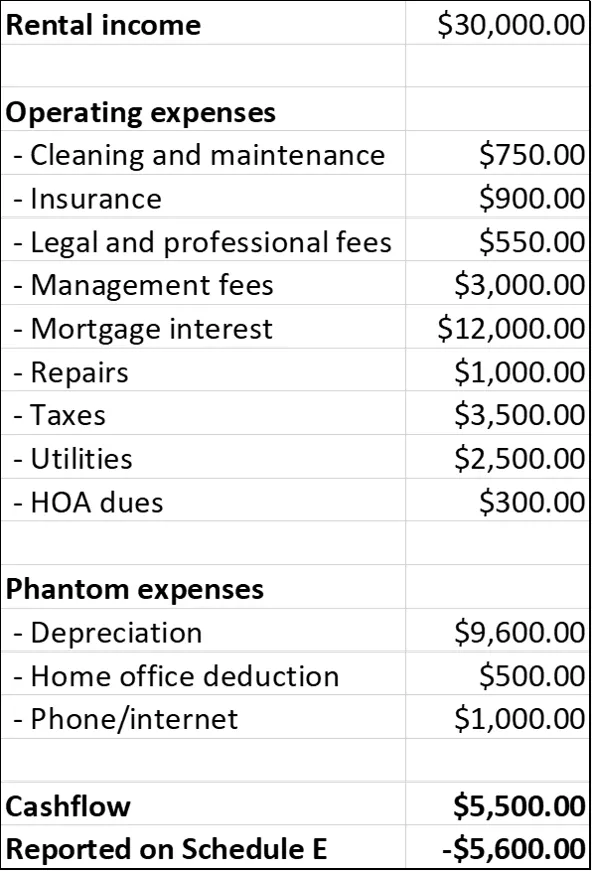

How Rental Income Tax Works Tips For Reducing Tax Burden

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Reasons To Keep Your Rental Property On Q Property Management

Tax Benefits Of Accelerated Depreciation On Rental Property

14249 Schedule E Disposition Of Rental Property

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Rules Schedule Recapture

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Calculate Depreciation On Rental Property

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Moving